Online marketing is rapidly growing in the Kenyan Market with most companies and entities using internet to get their business known and creating awareness to the consumers. Most companies are using the web and email. Kenyan consumers find it convenient to use internet search engine by simply using their internet connected gadgets. Online Marketing companies in Kenya have grown from 8678 last year (2013) to 10034 this year (2014).

Apart from the marketing companies which market other entities through advertisement of jobs or their goods and services, each of the Kenyan company, entity or institution has a website to create awareness and give information to the society. Advertising field is slowly losing other advertising tools like Billboards, Posters, Newspapers, Television, Radio and road shows. This has been proved true by a study conducted in Nairobi Central business area where several business headquarters are located.

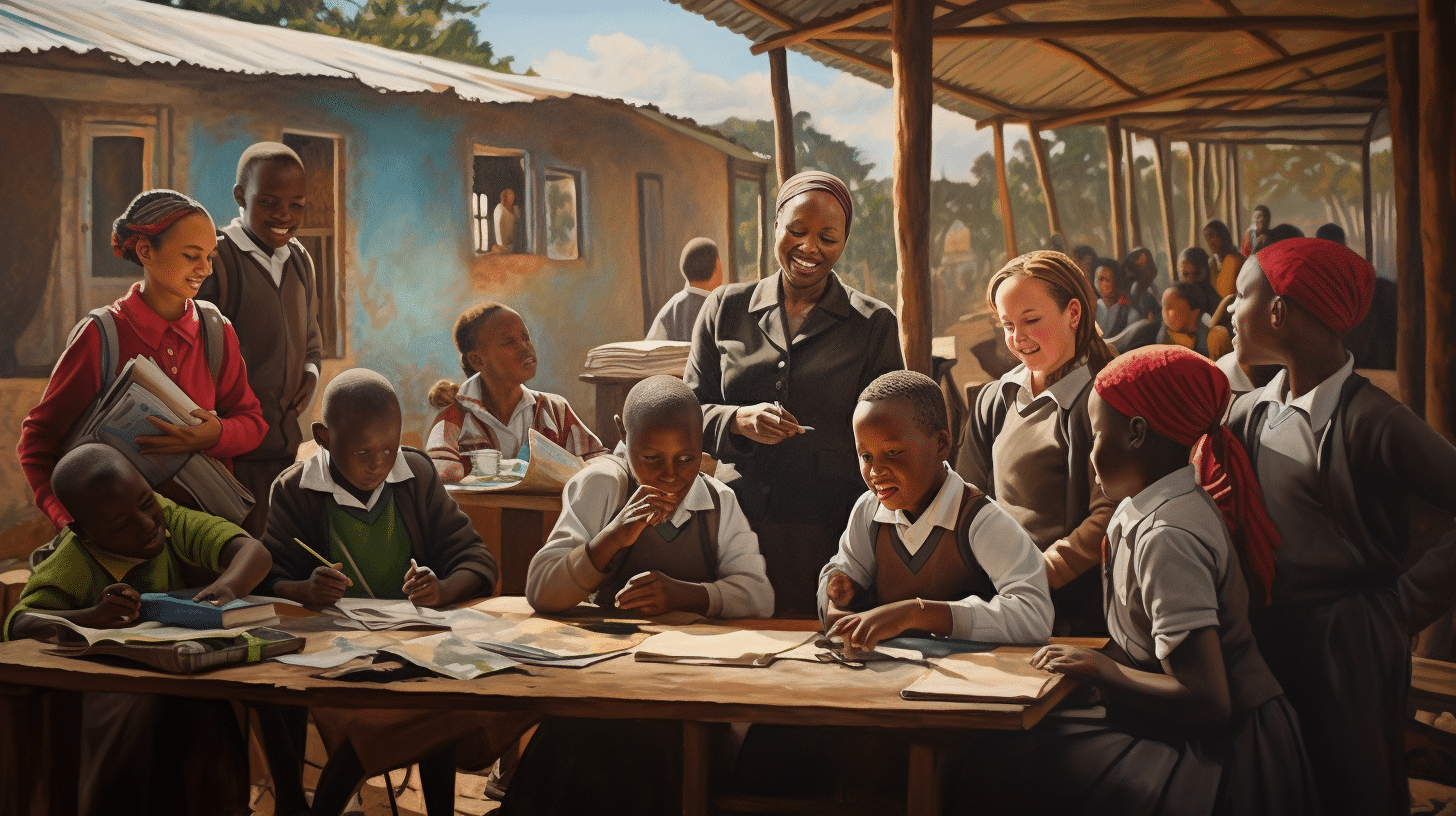

The study conducted between the month of January 2014 and April 2014 by use of face to face data collection and questionnaires. 200 operating businesses in the Nairobi central business center were studied. Among the two hundred, 20 were government entities.

The multinational companies used different adverting tools which included consulting Marketing agencies, billboards, television and newspaper with a higher percentage cost and emphasis going for online advertising. National companies used online and newspaper. Small business entities used online and posters.

Most advertised areas were products and services offered, career openings and tenders. Multinational companies consulted for career advertising and recruitment, National businesses advertised their careers in the web and the newspaper and small operating businesses used posters to advertise for job opening. Government entities used newspaper and website.

Information technology departments were responsible for the technical adverting of the business. Banking institutions were advertising to both external and internal customers about their new offers using brochures; the brochure referred them to their website for more information.

Eighty two percent of the businesses had their own website but still used other online advertising companies to create awareness to a bigger audience. Electronics and property companies were engaged in online marketing more than fast moving consumer goods producing companies.

Modes of advertising like use of radio seemed to be very low followed by use of road shows, Government entities engaged themselves in advertising compared to other entities. Multinational companies engaged themselves in advertising in a higher rate compared to other businesses.

Advantages of using online Marketing

-

It saves time and money compared to other ways of creating awareness.

-

It not tedious hence saving labor energy.

-

It is easily accessible in this generation where internet services are convenient.

-

It gives more details about the product or services being advertised which is contrary to other modes of advertising.

-

It is a fast mode of sales because of the introduction of online selling.

-

It has led to income generation to those who own advertising websites.

-

It can be done anywhere any time hence giving easy time for the managing directors to track their business records.

-

Online advertising attracts customers from any corner of the world hence growth of the company.

-

It has reduced congestion in many offices with people wanting to enquire about a certain service or product.

-

It has become easy for the customers to search for goods and services and compare the quality and prices without going to window shop.

-

Young entrepreneurs are picking fast in the business due to use of online advertising.

Disadvantages of online marketing

-

It has led to close of different marketing agencies who used other modes of advertising

-

One has to keep on updating the website for the search engine will consider the most current adverts especially in the advertising websites.

-

For every consumer to be updated they have to use internet services which is costly compared to just reading a poster, billboard, listening to radion or watching television.

-

Stiff competition has gone up in companies with each going online and some being experts in their online advertising than others.

-

Only computer literate and internet users are targeted online marketing locking up the other population who do not use it.