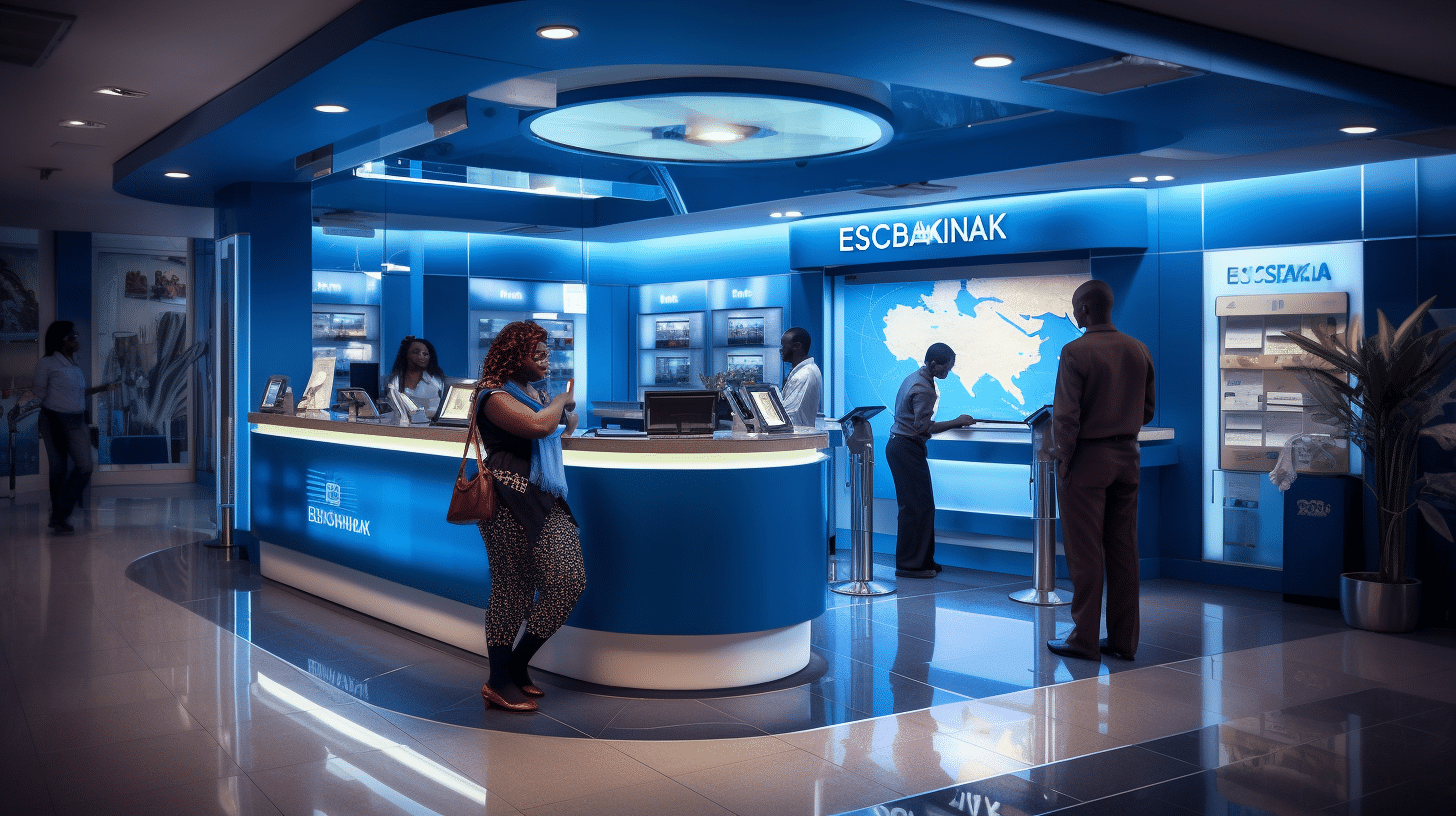

There is no doubt that the number of banks which are setting up base in Kenya today has been rising exponentially over the recent years. This has even seen the entry of various international banks into the Kenyan market. Sharia compliant banks in Kenya are also increasing in number pretty much. Basically, the banking industry in Kenya is growing at a fast pace, and that is definitely something that Kenyans ought to be proud of.

With this in mind, accessing banking services in Kenya has become quite simple in the modern day Kenya. You can register and open an account in Kenya in whichever bank you prefer. You can access ATM services in Kenya while in any town or shopping centre in Kenya. However, these developments are pretty much vivid within Nairobi. In Nairobi, you will come across an ATM machine in every corner you go to. This includes shopping malls, supermarkets, recreational centers, bars and entertainment joints among many other places in Nairobi.

Most of these ATM machines in Kenya are VISA branded. This means that, if you have a VISA card in Kenya, you can withdraw your money at any of ATMs in Kenya, regardless of having a different bank. However, withdrawing and depositing money at the ATM in Kenya is not the only thing that you can do with your VISA card in Kenya and especially in Nairobi. With your VISA card in Nairobi, you can enjoy a wide range of benefits such as;

Worldwide Acceptability of VISA card

When a Kenyan has a VISA card in hand, the Kenyan can enjoy access to their money at over 28 million banking outlets across the globe. You can withdraw your money at any ATM at any time as long as it has a VISA sign. What else can you ask for? This is definitely the best thing that would ever happen to you.

Purchase Goods and Services using VISA card in Kenya

Secondly, when you have your VISA card in Kenya, you can conveniently pay for services and goods at the hotels, supermarkets, hospitals, fuel stations and many other retail outlets all over Kenya. Remember that, in all these scenarios, you can swipe your VISA card in Kenya at no extra charge. Remember that, when you are doing your shopping in Kenya, you could also withdraw your money at those shops using their Cash Back services in Kenya. Withdrawing at the Cash Back services in Kenya comes at a minimal fee.

Pay your bills and save time with VISA card in Kenya

Thirdly, when you have your VISA card in Kenya, you do not have to worry about queuing at the ATM or bank branch in Kenya in order to withdraw money. If you want to pay for bills in Kenya, you can use your VISA card to pay up at any supermarket in Kenya. You can also use VISA card to pay for a wide range of utility bills in Nairobi.

Using a VISA card is safer than carrying cash

Since you are the only one with access to your VISA card in Kenya, you can be rest assured that your money is safe at all times. Even if you lost the VISAcard in Kenya, your money will still be intact. Money can only be withdrawn from your account by someone who clearly knows your PIN number. That is why Kenyans are always advised not to share their Pin numbers with other people so as to keep your money secure.

Deposit cash directly to your account using VISA card

Last but not least, you can still use your VISA card to deposit cash in Kenya into your bank account. Remember that you can do this any time at any deposit ATM in Kenya.

Kenyans are now embracing VISA cards usage in Kenya. Banking could never get any easier and user friendly like it is in Kenya.