The Kenya Revenue Authority (K.R.A) is the tax collection agency of Kenya which performs on behalf of the Government of Kenya. Kenya Revenue Authority in Kenya collects a number of taxes and duties, including: income tax, value added tax and customs.

In order to be able to carry out various transactions in Kenya such as business banking, investments, land transactions, employment, applying for HELB loan among others, one needs to have the Kenya Revenue Personal Identification Number.

How to get a KRA PIN in Kenya

The question you might be asking yourself is how you can get this KRA PIN Number in Kenya. The Answer is simple; the whole process of getting a KRA PIN in Kenya can be done online whereby you submit the required information once you visit their website at https://mapato1.kra.go.ke/itms/

Once you have been able to access KRA online page in Kenya, you will be welcomed to the KRA online service where you will be given the option to either login, retrieve lost password, or new taxpayer option. As a new tax payer in Kenya, click on new tax payer option.

Once you have done that, you shall be directed to a new page whereby you shall be prompted to enter the following; ID Number, Date of birth, District of Birth, Mother’s Last Name, Father’s Last Name and your Year of Birth. For the Date of birth select day on the calendar, month (from the pull down menu); for year click the button with three dots on the pull down menu and click on the – sign until you get to the year you were born.

After successfully completing the required field on the KRA online page you shall be taken to another page where you will find a form that requires further information from you such as; Area of residence, phone number, parents identification number, your personal email address and taxes that you as a taxpayer entitled to pay in Kenya.

Upon successful completion of the KRA online form with the correct Taxpayer Registration details, the KRA online system will allocate the ‘PIN’, ‘Password’ and ‘Security Stamp’. These will be sent to you through the e-mail address you had provided in the form

The KRA PIN will act as the Taxpayer’s Personal Identification Number, the Password as your secret access number to use the system while the Security Stamp will act as your secure number generated by the system and is only used once upon the first login into the system.

Once you get your KRA PIN number in Kenya, you can register online and print the PIN details. You will now be required to enter your Identification which in this case will be your KRA PIN Number. As for the password, you should have received it on your email together with the security stamp. If not, you will need to go to KRA Times Tower in Nairobi and request it to be reset including your email address. KRA offices in Nairobi are located in Times Tower on Haile Selassie Avenue in Nairobi CBD. Kenya Revenue Authority offices are located opposite Central Bank of Kenya and next to Office of Commissioner General in Nairobi town in Kenya.

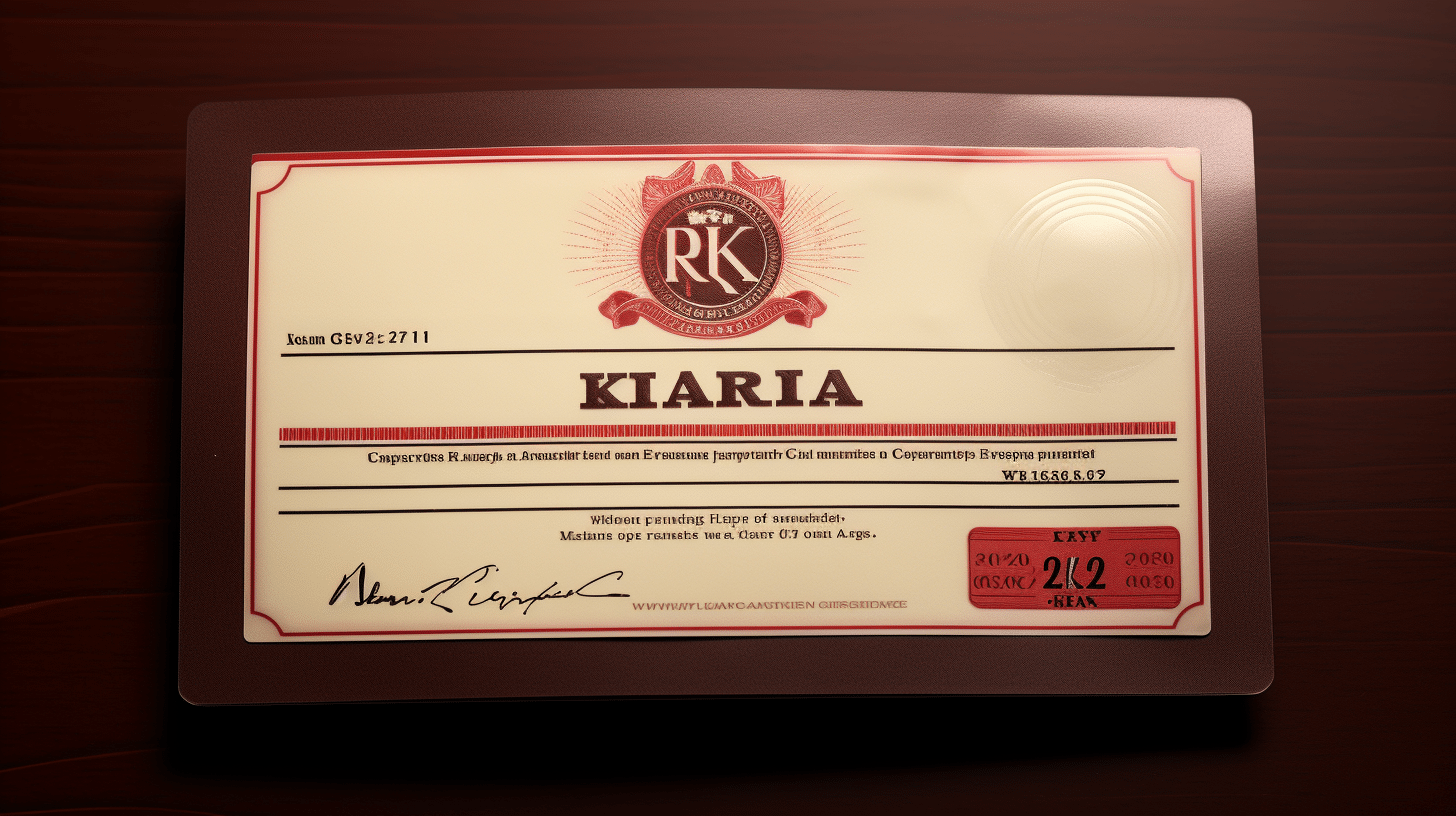

How to print a KRA certificate online in Kenya

In order for you to print your KRA PIN certificate in Kenya, you will need to click on the link “Registration Certificate” which is under the “Registration Application“ link After that one just simply needs to print it using an ordinary printer and you will be done with the entire process and you will have the certificate.

The online method of applying for a KRA PIN and printing of KRA certificate in Kenya is generally efficient to Kenyans since it saves on time and money that would be lost if we all had to go to KRA offices in Nairobi to register. And the best part is that it is free and easy and requires no extra special skills to apply for a KRA PIN in Kenya. Furthermore, one can do it on their own as long as they have access to a computer and internet connection and can also print a KRA certificate in any section of Kenya.

0 comments