Banking in Kenya is the most advanced mode of society in which the people have embraced and have ensured that their money are safe in the banks. Banks offer their customers the best services they can to ensure that their customers are happy and will view banking of their money beneficial to them than any other form of saving money. Most of the people in the society use banks for their savings and therefore they try to find the best banks that have high interest rate in order to get most out of the money.

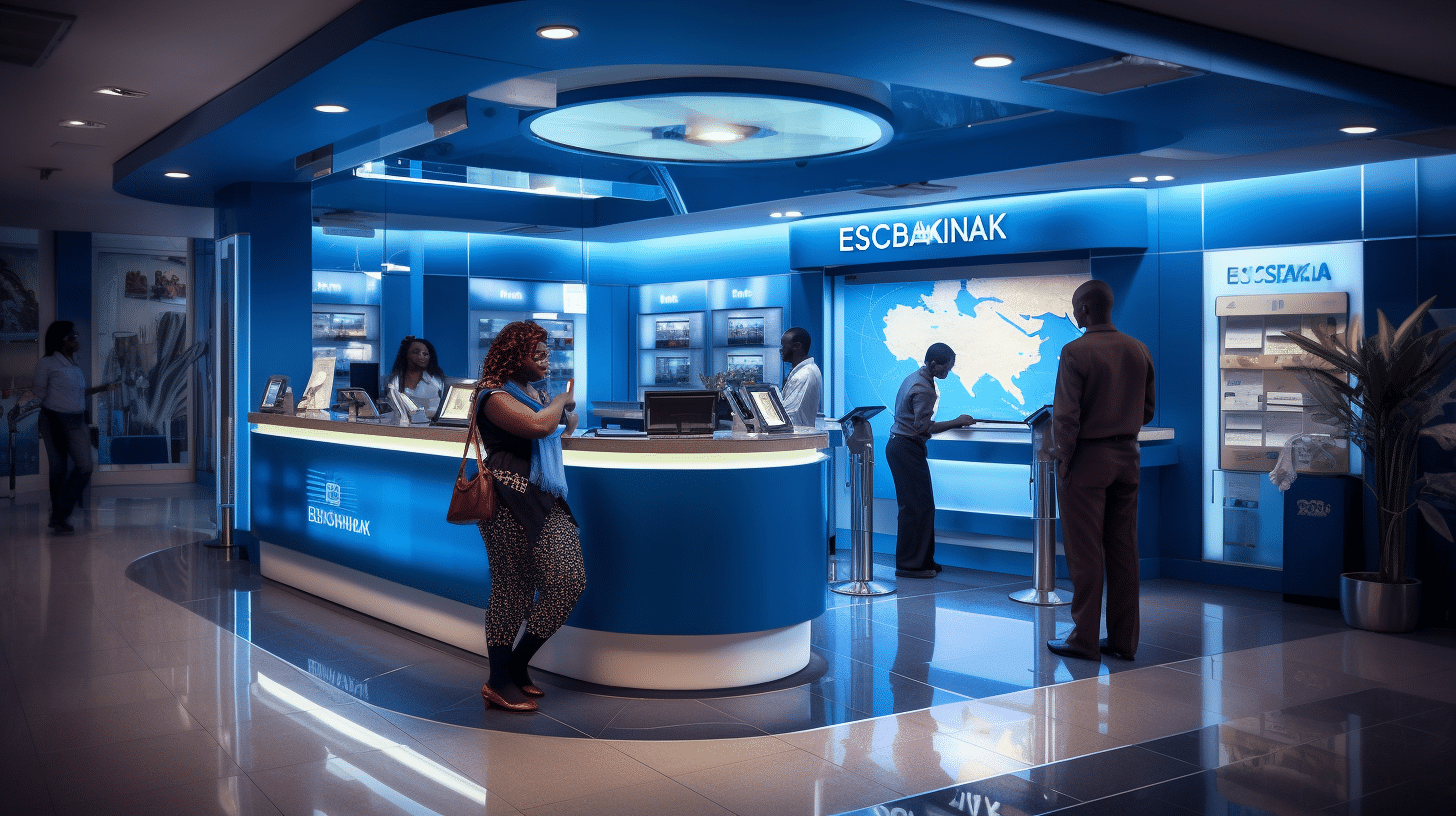

Ecobank is therefore one of the banks which ensure that the people can be able to access banking services with ease and conveniently. Ecobank was established to enable the people to bank their money easily and efficiently. This bank has a lot of services which may or may not be found in other banks. The services they offer ensure that their customers are the sole beneficiaries and that it provide the best customer and bank relations.

The first services that Ecobank provides that may not be found in other banks is the rapid transfer service in Ecobank. This offers the customer the fastest, convenient and most reliable means to transfer money. Ecobank offers a fast, convenient and reliable means to transfer money across the sub region. To use this service, contact Ecobank branch near you and issue them with a signed written instruction to withdraw money from your account in the form of a cheque or a letter-stating your account name, number and amount to be withdrawn. Present your acceptable Id or a passport. With the Rapid Transfer method, you can as well pay for utility bills from anywhere along paying bills abroad from your Ecobank account based in Kenya.

Secondly, Ecobank present the customer with the Foreign Exchange programme which becomes your partner as they are market leaders in Foreign exchange transaction whereby they guarantee flexible and well-structured deals, timely, comprehensive and assured delivery with competitive rates. Ecobank also through the Foreign Exchange programme ensure that they present the customers with the most highly skilled experts who provide their customers with special advisory services on how to use the Foreign Exchange programme and make a lot of benefits from the service.

Thirdly, Ecobank provide their customers with a variety of loans on which the customers can borrow loans and pay back within a reasonable period of time with what Ecobank term as low interest rates. They present the customers with the personal loans or the business loans. The personal loans ensure that the people who have personal accounts have been presented with the most important opportunities that they can really get from any other bank. The personal loans offered by Ecobank include;

- Personal loans to finance the rent payment, asset and equipment acquisition, salary advance, personal problems, funerals and much more.

- Car and Moto Loan to enable their customers own their dream cars, motor bikes or vehicles for commercial use such as Matatus and buses. They ensure that the payment period is reasonable and have the most competitive rates and repayments options are very convenient to the customers.

- Mortgages/Home loans is yet another loan that is offered by the Ecobank which present their customers with flexible loan packages for the house of their dreams, or exclusive retreat where their children can grow up in a relative comfort and safety.

Lastly, Ecobank due to their good services, they have different forms of accounts which present variety of features to the people who are interested in banking in Ecobank. The accounts can be personal or business accounts which are opened by an organization or corporation. The common accounts that most Ecobank customers prefer are the current account and the saving accounts. The Current account present the account holder with different benefits and features that they can enjoy as Ecobank Customers. The features that the current account comes with include cheque services, linked saving account, standing order, SMS alert, monthly e-statement, Debit Cards with Master Card available and internet banking. On the other hand, the saving accounts ensure that the account holders get most out of their money and save for the future. The Ecobank Saving Account present the older with a debit card which gives them access to over 4,000 ATMs and POS terminals across Africa. Other features that are accompanied by the saving account is internet banking services,, mobile banking, SMS-alert, monthly e-statement and much more.

0 comments